Mothernode CRM offers a variety of ways users can adjust tax settings by adding flexibility when applying taxes. For example, different customers or offices may have different settings to make sure the correct tax is being used or in some cases no tax at all when creating new transactions, such as quotes, orders, or invoices. While Mothernode gives you the necessary flexibility you need to make adjustments to your tax settings, at multiple levels, Mothernode receives its tax information in real-time from a third-party tax authority service. Therefore, users are ultimately responsible for making sure their record settings are correct. Tax settings do not include tax rules that might apply to goods and services being sold in different states or counties.

Mothernode customers should familiarize themselves with their state tax policies before proceeding with Mothernode’s tax service. Mothernode customers can also choose to enable or disable Mothernode’s built-in tax lookup service. Because users can override tax settings, Mothernode recommends accounting departments review tax rates before all final invoicing.

What might cause a tax rate to be incorrect? And what to look for.

Mothernode is an incredibly powerful, feature-rich software that gives users plenty of flexibility in their workflow. With that said, convenience can often borderline sloppy when using shortcut methods to create transactions. Errors with Tax rates are often caused in some of these or similar circumstances:

- Users duplicate a transaction and assign the transaction to another customer with a different zip code or tax lookup rule.

- Users duplicate a transaction and assign the transaction to another location with a different zip code or tax lookup rule.

- Users duplicate a transaction and change the address and zip code, ultimately changing the rate.

- Users don’t use Tax Exempt numbers in transactions and instead apply a 0% tax rate. This may have a longer-term impact on non-tax exempt transactions.

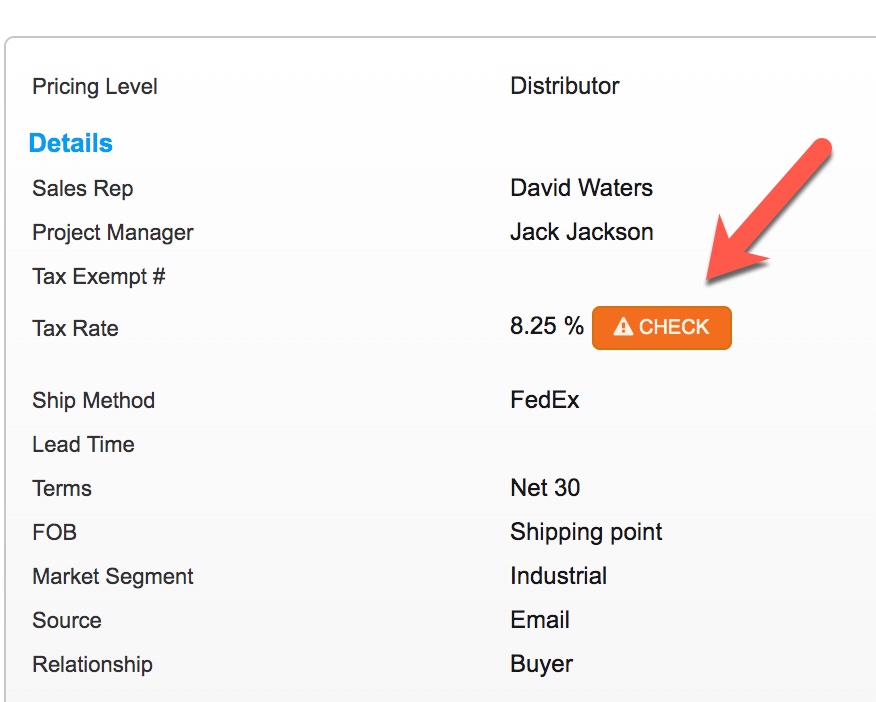

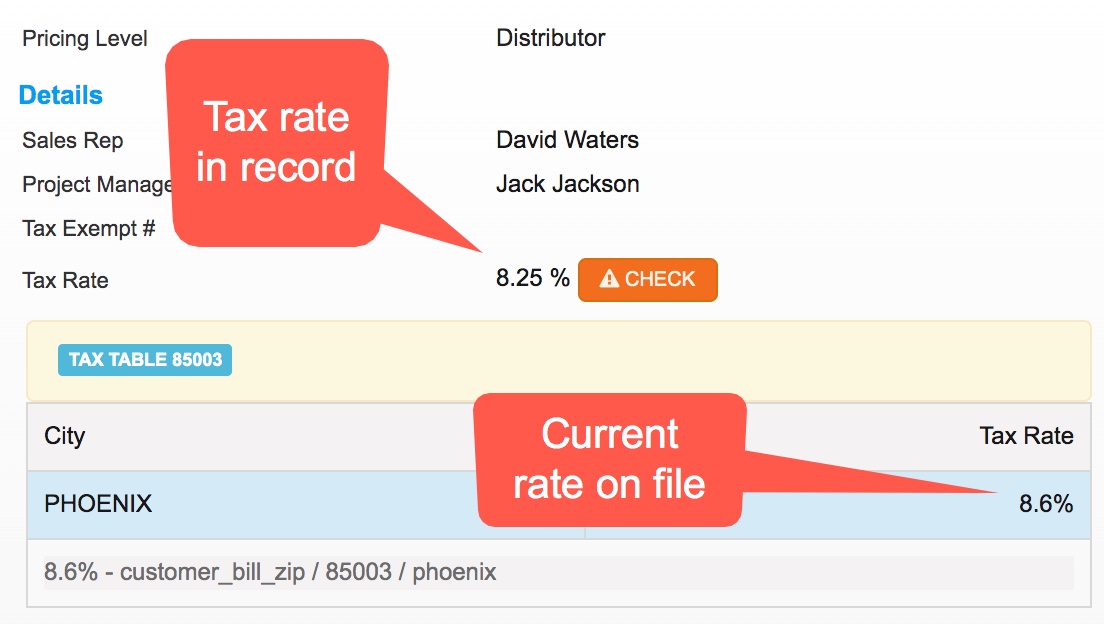

When changes are made to the original address applied in the transaction Mothernode will cross-reference the current tax rate used in the transaction with the new zip code being applied. If there is a discrepancy, Mothernode will display the Check-tax notification.

Clicking the notification will reveal the discrepancy:

To correct the issue and use the new tax rate, EDIT the transaction header and click UPDATE TAX:

![]()