When working in Quotes, Orders and Work Orders (in applicable editions) sometimes you may be in a situation where customers (or a transaction) will be Tax Exempt and therefore your transactions cannot include tax rates. Mothernode can account for this in a couple of different ways.

It goes without saying that you can simply assign 0% to the tax field and tax will not be calculated in the transaction. Mothernode does offer some improved functionality to help prevent mistakenly charging tax to your customer in a current transaction and in future transactions.

Assigning Tax Exempt Numbers to Customer Accounts

When creating transactions for customers who have a Tax Exempt number on file, a foolproof way to not mistakenly charge tax on any of their quotes or orders is to add their Tax Exempt number to their customer account.

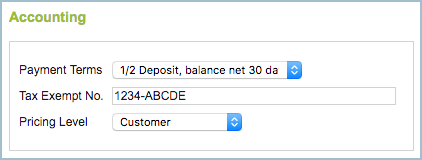

In their customer record:

- Click Edit.

- Click the Billing Tab.

- Add the Tax Exempt Number.

- Save the record.

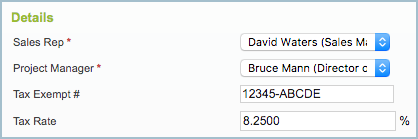

Adding Tax Exempt Numbers in a Transactions

Users can also add (or modify) a Tax Exempt number in a transaction, under the transaction header tab. This is ideal for one-off instances, but if there are recurring transactions or you plan on adding more, we recommend adding the Tax ID number to the customer record. This way the Tax Exempt number on file will always populate the Tax Exempt field in the transaction.

Adding the Tax Exempt no. to the transaction

- Open the transaction

- Click Edit in the Header Tab.

- Add the Tax Exempt Number/

- Click Save.

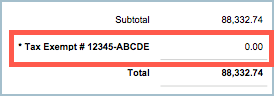

The result:

- The tax will not be calculated on the transaction.

- The printed transaction summary will zero the tax rate and include the Tax Exempt No. for reference purposes.