Mothernode CRM integrates with third-party tax services that allow users the ability to add applicable tax rates to transactions such as Quotes, Orders, Invoices, Purchase Orders, and Work Orders. This service only provides baseline tax rates based on the specified tax policy and doesn’t apply any applicable tax rules for any products, services, or projects controlled by state tax legislation such as tax exemption policies. Customers are encouraged to educate themselves with the necessary state tax regulations and check which tax rate settings they should use. Customers have the ability to disengage Mothernode’s tax rate options and proceed to manually add taxes themselves if they do not want to use this feature.

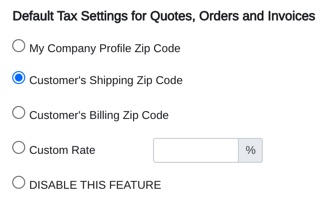

To set up your default tax settings in your Mothernode account, read the article about setting up default tax settings.

Customer Accounts

Assuming your default tax setting has been configured, each of your customer accounts will default to the tax settings configured in the admin section. The customer policy will be used to provide a tax rate in transactions created for that account.

Note: New Leads and Opportunities will use the system defaults.

In the customer account you can view and edit the customer’s default tax settings by accessing the customer’s billing preferences and settings.

- Open a customer profile

- Click EDIT

- Click the Billing Tab

The system policy defaults will be used unless they have been overwritten for the account. You can override the policies for an account and SAVE them to initiate the update.

Tax-Exempt Accounts

Mothernode also allows users to define tax-exempt accounts by applying and storing the customer’s tax-exempt number on file. When a tax-exempt number is on file all transactions for that customer will default to 0%. Click here to learn more about using tax-exempt numbers.

Transaction Tax Rates

When creating a new transaction, such as a Quote or Invoice, they will inherit the default tax settings set for the customer they are created for. In the case of Quotes created for Leads and Opportunities, the default tax system setting will be used.

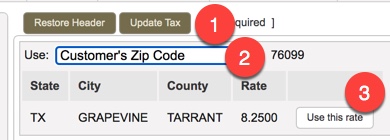

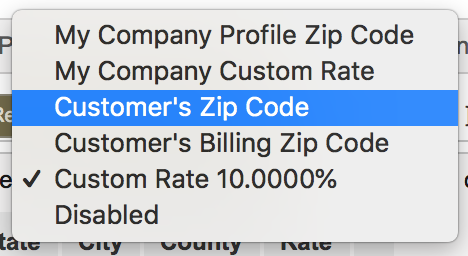

The tax settings for transactions are located in the header. These settings accomplish the following:

- Display the current policy being used

- Change the policy using the drop-down menu options

- Update the current tax rate for the policy

Quotes, Orders, Invoices, Purchase Orders

* Users should know their policies and tax rates and always check with their accounting departments and state legislators for current tax information.

Duplicating Quotes

When duplicating transactions the tax rate used in the source transactions is the tax rate that will be used in the duplicated version. This will replicate any custom tax rate applied and/or tax rates that were used in the event the auto tax service is disabled. As a best practice, when users are duplicating transactions from previous months or years, they should click the Update Tax button to ensure the most current tax rate is being used. Users should also check with their accounting departments to make sure there haven’t been any changes to the original policy selected.

![]()

Lengthy Sales and Fulfillment Cycles

In the event that sales tax rates for selected policies change during the sales or fulfillment cycle, users should use the update tax feature or manually update tax rates before issuing invoices to make sure the current tax rate is being used. Mothernode customers should also familiarize themselves with the latest tax legislation and exemptions in the regions in which they do business.