When syncing transaction records to QuickBooks you’re going to need to make sure the correct tax rate is set up in QBO or QBD before sending. You can either add new rates within the Mothernode CRM transaction, which will add the tax rate code to your QuickBooks account or modify your QuickBooks tax rates in QBO or QBD.

The QuickBooks tax rate code is separate from the standard tax rate field used throughout Mothernode to calculate tax within line items. The QuickBooks Tax Rate Code is used exclusively for QBD and QBO transactions synced to Mothernode CRM. Click here for more information on QBO and QBD tax codes.

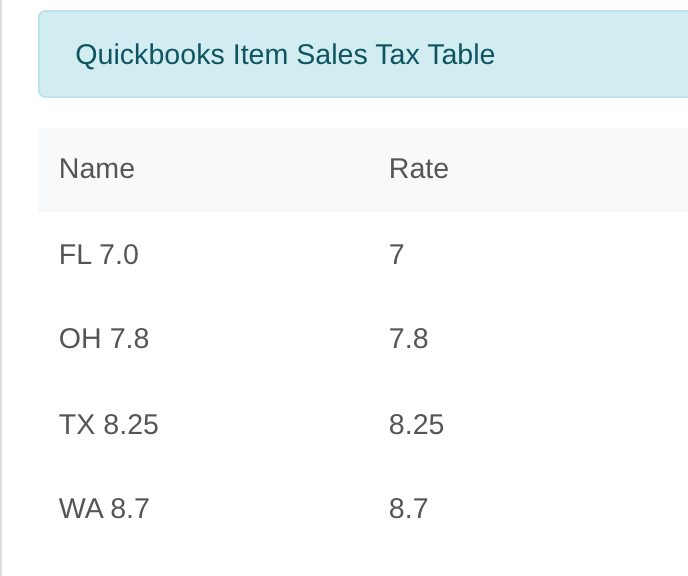

Your existing QBO and QBD tax codes are displayed in the QuickBooks API section of your Mothernode CRM account once you successfully connect your QuickBooks account and perform your first sync.

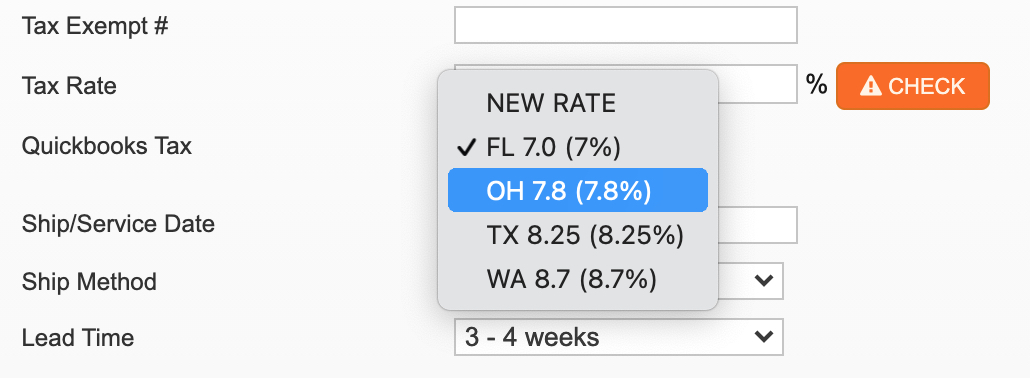

With Mothernode CRM Connected to your QBO and QBD account, users will also have access to this information in the Quotes, Invoices and Purchase Order headers because these are the 3 transactions that can be synced with your QuickBooks account.

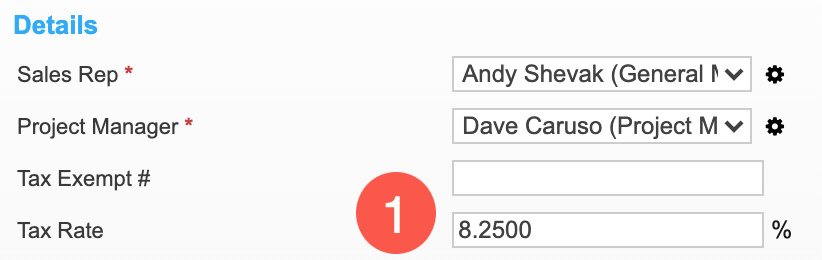

Example of a Mothernode Account connected to QBD or QBO

- The sales tax rate is used to calculate tax on goods and services sold in the transaction.

- The tax code and rate are set up in your QBD and QBO accounts.

Example of a Mothernode Account without QBD or QBO connection enabled

- The sales tax rate is used to calculate tax on goods and services sold in the transaction.

Setting the QBO and QBD Tax Rate

When working within the Quote and/or the Invoice header users can set the QuickBook tax rate from the available drop-down list or add a new one to the QuickBooks Tax Table from Mothernode.

For additional information about QBO and QBD Tax Rates, see these articles.

- QuickBooks Sales Tax (QuickBooks Online)

- QuickBooks Sales Tax (QuickBooks Desktop)

- Using Taxes in Transactions)

- Avoiding Tax Rate Issues

- Default Settings – Tax Setting